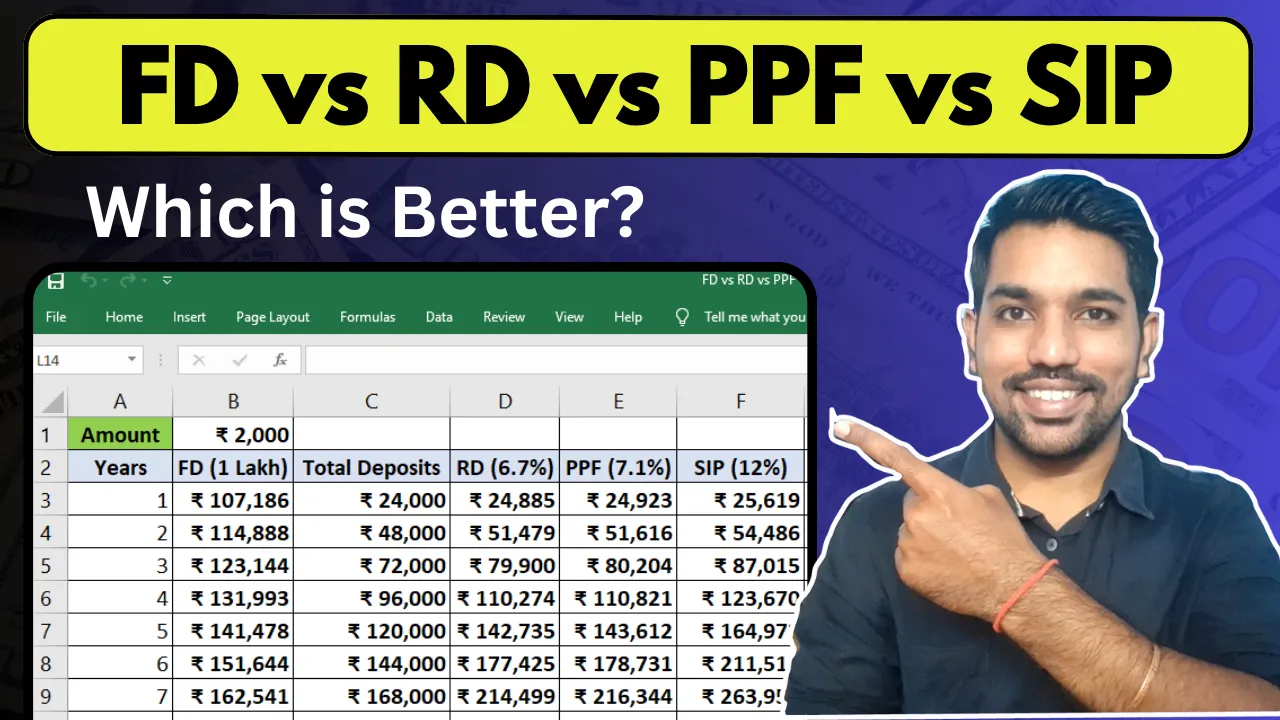

If you have big aims such as buying a house, saving for your child’s education or if you are saving for retirement, planning your finances is useful. Among the best ways that people in India can invest for the long term are SIPs (Systematic Investment Plans) and FDs (Fixed Deposits). While SIPs involve mutually investing annually/monthly, FDs allow you to deposit a fixed sum in the bank to get a guaranteed interest. You can use a SIP return calculator to approximate how much your investments may grow after some years. Every alternative has its pros and cons, and choosing the right one depends on your goal, risk tolerance, and time horizon.

How Return and Interest Calculators Help You Decide Between SIP vs FD

Becoming future-ready and growing your wealth over the years can be beneficial. Let’s understand about them in detail:

1. Helps Compare Returns Easily: Among the most important things for you to look out for when investing your money in a Systematic Investment Plan (SIP) or a Fixed Deposit (FD) is the return you will get. Return and interest calculators show you this clearly. They present to you how much your capital can be built within a time frame depending on the prevailing interest. All you need to do is to fill in a few details, like how much you want to invest and at what rate.

2. Shows the Impact of Time on Investment: These calculators illustrate how your money grows over time. With FDs, the interest is fixed, so you can see exactly how long it takes to accumulate a particular number. In SIPs, time also has an important role to play, as the longer you remain invested, the more you are rewarded for growth. The calculators help you see that starting early and staying invested longer often leads to better returns.

3. Helps Match Your Risk Level: FDs are said to be safe as they provide guaranteed returns, and they are more flexible when having certain market risks involved. A calculator lets you know how much risk you take with every option. You can play with various interest or market return rates and see best-case and worst-case scenarios, especially SIPs.

4. Supports Goal-Based Planning: Return calculators are useful if you have a goal – saving for car expenses or a child’s education. They assist in knowing how much to invest every month in a SIP or as a lump sum in an FD to achieve the goal in a given timeline. This makes your financial planning easier and easier. FD calculators can show how much you should invest now to get a certain amount after a few years.

5. Saves Time and Avoids Guesswork: Without calculators, you would have to do many calculations to compare the SIP and FD options. Using return and interest calculators saves you time and effort. You get the results instantly, which helps you make quicker decisions. Instead of estimating returns or interest, you get a clear picture based on real numbers.

Final Words

To sum up, by using return calculators for SIPs and FD interest calculators, investors can compare real outcomes correctly. SIPs offer market-linked returns and the potential for wealth creation over time, while FDs provide capital safety and fixed returns. Moreover, an FD interest calculator assists you in calculating the precise returns from your FD for a given maturity period, which implies ease of planning. Such tools provide a better overview of how your money accumulates over time, making getting an appropriate investment strategy easier.